Practice Value White Paper

Valuations of assets should be examined from the three valuation approaches, the Market Approach, the Income Approach, and the Asset Approach. This paper will concentrate on the Market Approach, using the Direct Market Data Method.

Practice values can be tracked statistically and the statistic with the most valid correlation is the Price/Revenues (P/R) percentage. This is more reliable than Price/Net Income data because expenses can vary widely by including elective and creative expenses and are likely to be not treated universally the same. The source of the Revenue denominator varies with different appraisers, but the statistic we use is the most current year end revenues or annualizing revenues of at least six months experience since the previous period ending date. Consider the following data.

This database sample has 271 data points.

- The average gross collections for practices in the database sample is $689,951

- The median gross collections for practices in the database sample is $593,771

- The average sale price for practices in the database sample is $442,232

- The median sale price for practices in the database sample is $369,000

- The average price/gross ratio for practices in the database sample is 63%

- The median price/gross ratio for practices in the database sample is 66%

- The standard deviation for price/gross ratios for practices in the database sample is 12%

- The price/gross ratio range for plus/minus one standard deviation is 52% to 75%

- The price/gross ratio range for plus/minus two standard deviations is 40% to 87%

This analysis consists of 271 practice sales. In this data progression, the average P/R ratio is 63%. The median for the population is 66% which indicates that ratios in the upper half of the population have incomes that are larger in proportion to the ratios in the lower half of the population.

The other interesting finding is that the mean practice gross is $442,232 and the median practice gross is $369,000, indicating that the practice gross incomes in the upper half of the population are disproportionately higher than the practices in the lower half of the population.

We find that the mean P/R ratio is 63%, a very consistent finding over a period of time, and the standard deviation for the population is 12%. This shows how closely the data points are clustered, with one standard deviation, or 2/3 of the population, having P/R ratios in the range of 52% to 75%. Two standard deviations includes 95% of the population and practice P/R ratios range from 40% to 87%.

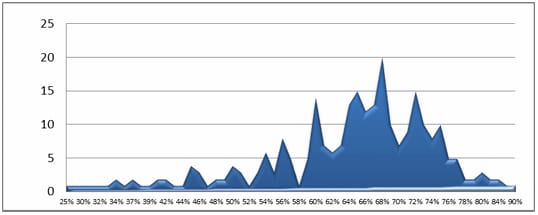

Here’s an interesting bell curve of distribution of P/V ratios.

The right skewed distribution in the above graph shows how the largest percentage P/R ratios are on the right side, explaining why the median value is higher than the mean.

Now we have learned a great deal statistically from this analysis, but what does it mean to you and your practice? Here are some key points to consider.

- The average P/R ratio is 63%

- That statistic is interesting but useless information.

- Out of 271 practices, only 7 practices, or 2.5% sold at the average P/R ratio.

- If a dentist assumed his practice was worth the average P/R ratio, his chances of being wrong are 97.5%

There is a large continuum of P/R ratio values, from 22% to 90%, and many factors go into determining where any one practice is valued. We have examined the statistics and owners can see where the boundaries are, but to know exactly where in that 68% variation their own practice lies, a professional trained, experienced and educated dental practice valuation expert is required.

Professional valuations take into account the market factors that drive a P/V ratio for the subject practice and how they compare to other comparable practices that have sold and the transactional data is known. It is tempting for an owner to value their own practice, but there is an obvious lack of objectivity in this process. Owners frequently feel that their practice is extremely unique and much more valuable and desirable than all other practices, and this is a common finding. In over thirty years of valuing practices, I’ve yet to have an owner tell me that I have overvalued their practice (unlike the buyers who examine them). It is true that each individual’s practice is quite unique, just like everyone else’s.

Valuators also must consider the cash flow ability of the subject practice and the ability of the cash flow to support the market approach values derived.

While there may be some very flattering market approach results for a practice, there is the practical aspect of the finance-ability of the practice pricing. If lenders cannot prove how the purchaser is able to pay the practice overhead, pay the debt service, and pay themselves, they are not likely to provide financing for such a price, therefore making the purchase inaccessible to most all buyers. The Income Approach to value determines how much a purchaser can afford to pay and at the end of the day earn a commensurate net income for the work that they did, and there should also be a profit component in addition to this salary component. The Income Approach is the topic of another white paper though